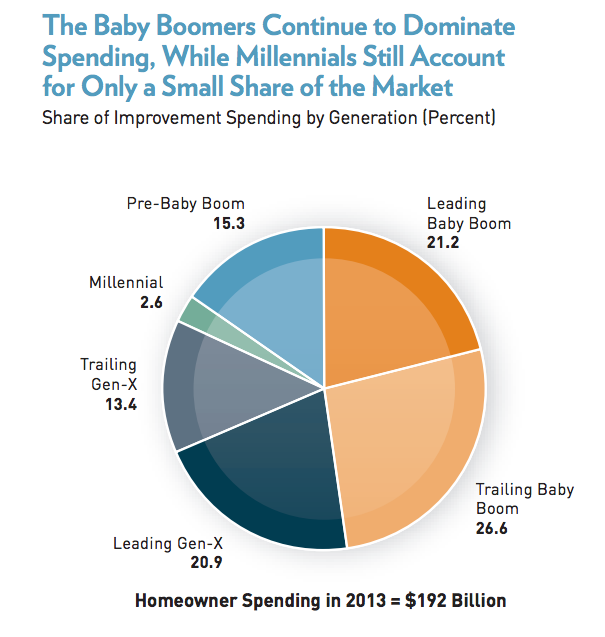

Baby Boomers Continue to Dominate Spending

Key Insights From the 2015 JCHS Home Remodeling Report

In the aftermath of the Great Recession, the U.S. home improvement industry has performed much better than the broader housing market, according to this new report from Harvard University’s Joint Center for Housing Studies. And although the levels of residential construction spending are still a long way from making a full recovery, the home improvement industry could post record-level spending in 2015.

Why? Because the US housing stock of more than 130 million homes requires regular investment to offset normal depreciation, and many households that might have traded up to more desirable homes during the downturn instead decided to stay put and make improvements to their current homes. Also, federal and state stimulus programs encouraged homeowners and rental property owners to invest in energy-efficient upgrades that they might otherwise have deferred.

There are a lot of important insights contained in this white paper, but one demographic nugget that jumped out to us was how, over the coming decade, the home improvement market will increasingly rely on older homeowners to generate growth. Baby Boomers will continue to control a large segment of the housing stock nationally; they have low mobility rates; and they have continued to improve their homes as they prepare to age in place. Going forward, these factors will give Baby Boomers significant motivation to spend some of the ample disposable income on home improvements.

While the Boomers are moving out of the prime home improvement spending years, they are still active in the market. They survived the housing downturn better than most other generations, buffered from the drop in house values by many decades of strong house price appreciation. Although average per-owner spending on home improvement projects declined more than 15% from 2007 to 2013, spending by owners aged 55 and over shrunk less than 9%, which means Baby Boomers accounted for almost half of all home improvement spending nationally in 2013.

By staying in the workforce longer, this 75 million strong generation has the financial resources to take on home improvement projects. But don’t expect them to follow their parents’ retirement patterns. As multiple studies have shown, Boomers are currently more likely to live in newer, suburban homes, and will continue to spend a lot on home improvements as the housing market continues to stabilize.

At the same time, more Boomers are also moving back into the city from the suburbs, to older homes they are remodeling because the urban social fabric and its cultural amenities help Boomers meet their fundamental psychological need of staying hip, staying relevant, and NOT FEELING OLD. From big cities to small towns and suburbs to in-town neighborhoods, this “me generation” will be painting, hammering, and upgrading for a long time to come.

Which is a good thing for home improvement brands and retailers.